Tools to get you from start to finish

Our tools support you at all stages of the homebuying process, from rates exploration through closing. Learn more about our early stage homebuying tools below, or create an account to try for yourself.

Get Started

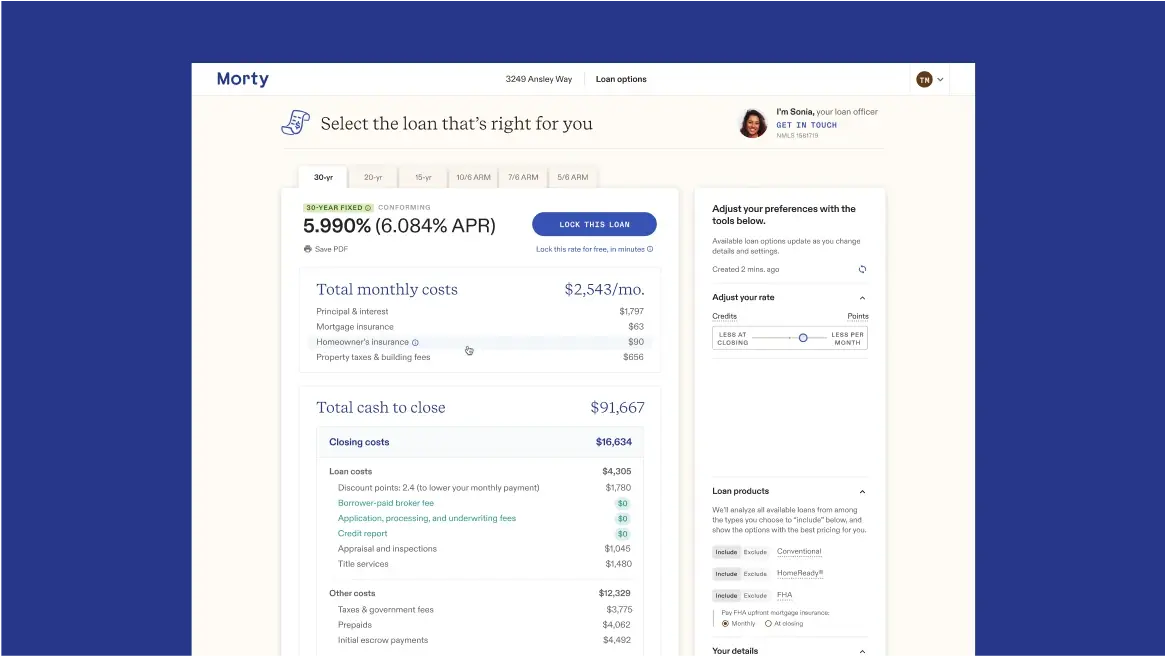

Interactive Quote

Most mortgage quotes get stale. Our’s don’t. With Morty’s Interactive Quote tool, you can compare different loan options in real time, get automatic updates every time the market moves, and calculate monthly payment and closing costs.

Purchase price and down payment

Adjust these in real time to see how it changes your monthly payment and interest rates.

Lower rate vs. Lower closing costs

Looking for a lower rate? Move your Points & Credits preference toward More Points. If lower closing costs are your priority, move it toward More Credits.

Loan type and lock period

Loan type and lock periodWe have a variety of loan products and lock periods up to 180 days. We make it easy to compare all your options in one place.

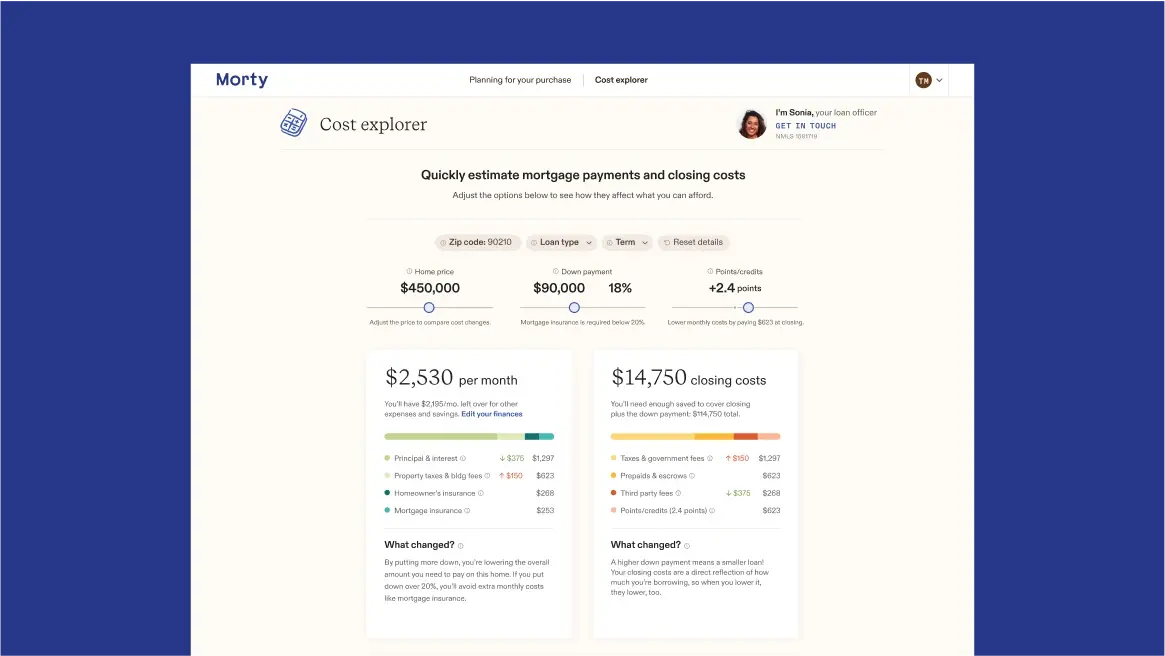

Cost Explorer

Take control of your budget with our Cost Explorer. Get tangible, helpful information to better understand your home buying power.

Little changes, big difference

Adjust your loan details and immediately see how it impacts your monthly payment and closing costs

Take control of your budget

Tangible, helpful tips to better understand your own personal affordability.

Follow the money

See exactly where your money is going, both in closing costs and monthly payments.

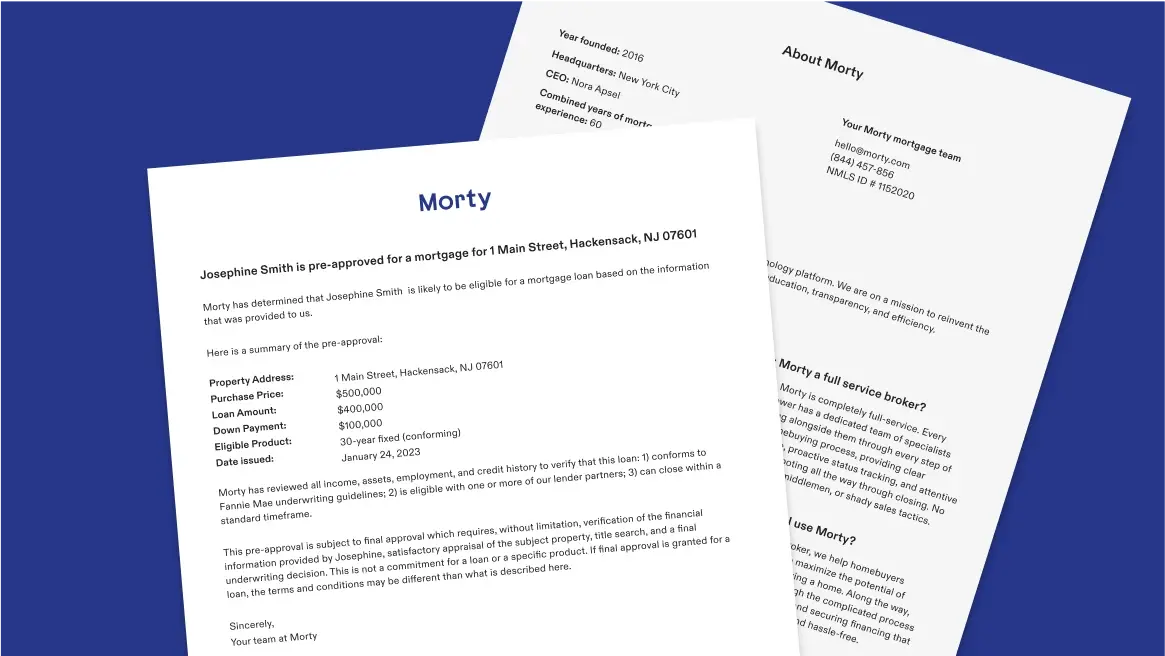

Verified Pre-Approval

Shop with confidence with verified pre-approval letter that signals to sellers you’re a qualified buyer.

Stronger offer as a buyer

Seller's know that your credit, income, and assets have already been reviewed. Next best thing to a cash offer.

Greater confidence for buyers

Knowing your financial profile has been reviewed by underwriting experts means there won't be surprises later on.

Faster closing time

Morty does the work for you up front so there is less paperwork once your offer is accepted, and you can close on your new home sooner.